Originally posted on LinkedIn

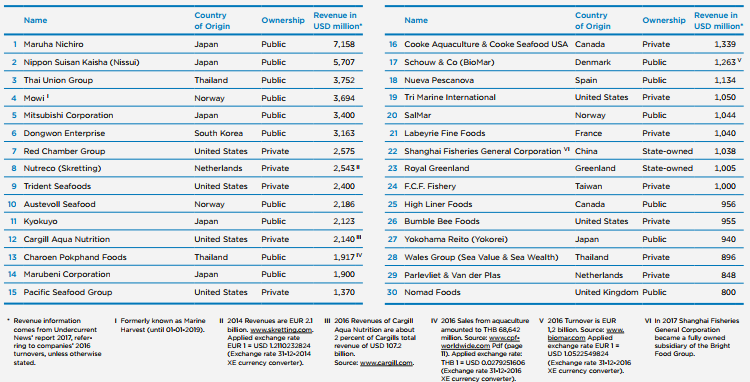

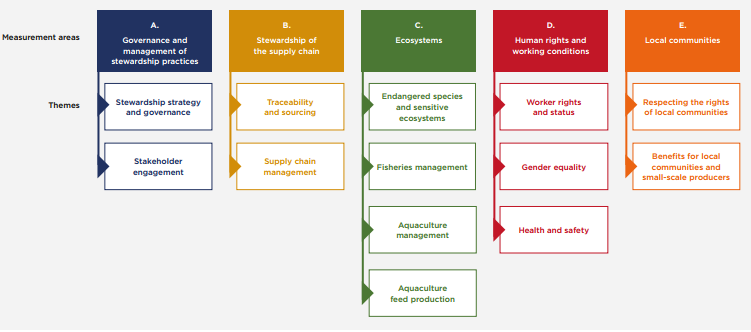

Thirteen months on and the WBA delivers its first official corporate sustainability performance scorecard: the Seafood Stewardship Index (SSI), devised in collaboration with those within the Seafood industry. Measuring the world’s thirty most influential seafood companies and ranking them based on their ‘sustainability performance‘ using publicly available data. Although commendable and much needed, the ratings seem based on only nominal numerator data across five measurement areas (A-E) and three weighted categories, namely commitment, transparency, and performance.

Thirteen months on and the WBA delivers its first official corporate sustainability performance scorecard: the Seafood Stewardship Index (SSI), devised in collaboration with those within the Seafood industry. Measuring the world’s thirty most influential seafood companies and ranking them based on their ‘sustainability performance‘ using publicly available data. Although commendable and much needed, the ratings seem based on only nominal numerator data across five measurement areas (A-E) and three weighted categories, namely commitment, transparency, and performance.

With upwards of three billion people dependent on seafood for their animal protein intake; making the industry accountable for its actions, by measuring and incentivising business impact towards a sustainable food system that works for everyone, is indeed a worthwhile goal. What is unclear from the study is how are companies demonstrating alignment with science-based targets and how are these calculated relative to what baseline (Compared to what?).

Therefore, it appears, that although this is a global study, it may be failing to contextualize performance relative to fair global allocations, social thresholds, and environmental ceilings and thus may falsely give the impression of sustainable performance. All we do know is that companies higher up on the ranked list perform better than those below it. However, one cannot conclude if one, or more, or any are sustainable. Put another way, the approach undertaken here is weakly sustainable.

The WBA says it plans to refine and improve its methodology over time as it will look to appraise 15 industries over the coming years and thereby cover the top 2000 companies by 2023. Noteworthy – and rather unsurprisingly – three Chinese banks feature in the top 10 global list and similarly four banks features in the top 10 Australian list. The WBA plans next to examine the top 100 ICT companies next year.

For those interested in evaluating a framework and methodology linked to strategy (business model) and engaging a strongly sustainable stance, that is multi-capital, values and context-based, featuring a scale-linked sustainability performance scorecard then click here and see how your business can THRIVE.

Is the well-being of people and planet important to you?

Discover how THRIVE Platform can help you contribute to a prosperous future for all of humanity.